Circular 2021/C/113 on the installation of electric vehicle charging stations and supplies and services related to those charging stations

Table of Contents

Delivery with placement of a charging station2.

Charging station installed at a company's premises 2.4.2.

Charging station installed at the employee's premises 2.4.3.

Charging of electric vehicles via a charging station

(Semi-)public charging stations 3.1.2.

Charging stations made available to employees 3.1.2.

3.1.2.1. VAT implications under the eMP

3.1.2.2. VAT implications on the part of the employee

3.1.2.3. VAT implications on the part of the employer

1. Introduction

More and more automotive vehicles are equipped with an electric motor for propulsion. The energy for these vehicles is supplied by a traction battery or fuel cell. There are vehicles equipped exclusively with an electric motor as well as hybrid models.

Car vehicles with an electric motor (hereinafter referred to as electric vehicles) can be supplied with electric energy through a charging station.

For the purposes of this circular, charging station is understood to mean charging stations and charging points consisting of an electrical connection with a plug to connect to the electric vehicle.

Charging stations include those that are incorporated into land. These usually qualify as real estate by their nature.

Charging stations include the outlets specifically designed for charging electric cars that are usually placed on the wall of a property. These usually qualify as immovable property by destination, and retain their movable nature for the provisions of VAT law.

Manufacturers offer this customized charging infrastructure that allows the battery of an electric car to be recharged in various places (e.g., on public roads, at the homes of individuals, at businesses).

This circular discusses the VAT rules applicable to the delivery and installation of a charging station, the charging of an electric vehicle and the right to deduct VAT.

2. Supply with installation of a charging station

2.1. Nature of the transaction

The supply with installation of a charging station with one or more charging points incorporated with the land is, in principle, considered to be a work in an immovable state within the meaning of Article 19, § 2, third paragraph, of the VAT Code. The charging station is usually placed along public roads or on private or public parking lots for electric vehicles.

Regarding the supply with installation of an individual charging station, the nature of the transaction should be considered in terms of the factual circumstances. For example, installing a charging station on the wall of a building is not considered to be a work in immovable state but can be equated with it (see below).

For all charging stations installed in Belgium, the place of delivery with installation or work in immovable state is Belgium (Article 14, § 3, article 21, § 3, 1° and Article21bis, § 2, 1° of the VAT Code).

2.2. Tariff

The supply with installation of a charging station is in principle subject to the normal VAT rate, which is currently 21%. This is the case, for example, for the supply with installation of a charging station in a business building, along the public highway or in a public car park.

In certain cases, however, a reduced VAT rate may apply when the charging station is installed in a private residence (e.g., in an employee's home).

Heading XXXVIII of Table A, of the annex to the royal decree no. 20 on VAT rates provides, under certain conditions, for the application of a reduced rate for work on immovable property and certain other operations relating to a residence that was put into use as a private residence at least 10 years ago.

Although the supply with installation of a charging point for electric cars in a building is not considered to be a work in immovable state within the meaning of Article 19, § 2, of the VAT Code (since the machines and devices placed in a building retain their movable character or, at most, become immovable by destination), the act in question is considered to be an act assimilated to a work in immovable state. Such act is envisaged in point c) of § 3 of Section XXXVIII of Table A, of the Annex to the aforementioned Royal Decree No. 20.

More specifically, the supply and installation inside a building of a charging point for electric cars is considered to be an operation consisting of the supply and attachment to a building of the components or part of the components of an electrical installation. The reduced rate can be applied if the conditions of the relevant headings are met.

The supply and installation of a charging station for electric cars is considered an operation related to the actual home to which the reduced rate applies if it is placed

- in the actual private residence or on its external facade, or

- in or on the facade of the garage or carport of the occupant of the private dwelling, including private garage boxes of apartment buildings, and private parking spaces in or under an apartment building, to the extent that the apartment to which they belong is used as a private dwelling, or

- on the access road connecting the public road to the garage forming part of the actual dwelling or to the main access to the dwelling or building, or

- on the outdoor terrace that is part of the dwelling because it is adjacent to it.

If the charging station is not installed in the actual dwelling or more generally in a place other than that mentioned above, the reduced rate does not apply to its supply and installation. Indeed, acts that do not relate to the actual dwelling are expressly excluded from the reduced rate.

Consequently, the normal rate of 21% applies if the charging station is placed, for example, in the garden adjacent to the dwelling or in a parking space next to the driveway or in front of the building (see, inter alia, decision no. E.T. 80.398 of 01.10.1996 and the oral parliamentary question No. 805 by Ms. People's Representative Barbara Pas of 19.11.2015). The normal rate also applies if, for example, the charging station is placed in a garage box that does not belong to the occupant's private residence (e.g., if the occupant of a private residence does not have his or her own garage, but, for example, purchases a garage box near the private residence).

It should be noted that the reduced rate also applies when the charging station remains the property of the employer and the employer makes the charging station available to the employee for a fee or not. Peripheral number 50 of the circular no. 6 dated 22.08.1986 regarding the reduced rate in the real estate sector states that the use of the property must be taken into account and not the status of the person who is legally the principal of the work, in order to test whether the condition regarding the provision and billing of the service to the end user as provided for in item XXXVIII of Table A, of the Annex to Royal Decree No. 20, aforementioned, is met. Since the final destination is to use the charging station in a private residence, this condition is met.

It happens that a charging station is installed at a mixed-use building (private residence as well as professional use). If the private use is predominant and the professional use secondary, the reduced rate of 6% may be applied to the supply with installation of the charging station. If, on the other hand, this work in immovable property is carried out only on professional premises (for example, a charging station installed in a garage used exclusively for professional purposes), then the tax will be due at the normal VAT rate since this work does not relate to the home in the strict sense of the word.

However, if the private use is incidental because the professional premises are the main part of the building as a whole, the reduced rate of 6% is limited to the works that relate to the actual private dwelling (e.g. installation of the charging station in a storage room belonging to the private quarters).

For the sake of completeness, we also mention the possible application of headings XXXII, XXXIII, XXXVI, XXXVII, XL, of table A and of headings X and XI of table B, of the annex to the aforementioned Royal Decree no. 20 under the conditions set out in these headings, as well as the temporary provisions on demolition and reconstruction of buildings included in article 1quater of Royal Decree no. 20. A complete overview of the administrative comments on the reduced rate for immovable property and assimilated operations can be found in the VAT commentary under Chapter 7Section 4, paragraphs 8 ff. and Chapter 7, Section 5, paragraphs 10 ff.

2.3. Reverse charge

By way of derogation from Article 51, § 1, 1°, of the VAT Code, the co-contractor of the taxpayer established in Belgium who carries out one of the transactions envisaged by Article 20, § 2, of Royal Decree No. 1, relating to the scheme for the payment of value added tax, must pay the tax due on that transaction, when he himself is a taxpayer established in Belgium and obliged to submit a periodic VAT declaration referred to in Article 53, §1, first paragraph, 2°, of the VAT Code or is a taxpayer not established in Belgium who has had a representative approved in Belgium in accordance with Article 55, §1, or §2, of the VAT Code (see Article 20, §1, of the aforementioned Royal Decree No. 1).

The reverse charge, envisaged by article 20, of the Royal Decree no. 1mentioned above, is applicable to all immovable work within the meaning of Article 19, § 2, of the VAT Code and, to the extent that it is not immovable work, also to the transaction which has as its object both the supply and the attachment to a building of the components or part of the components of an electrical installation of a building, with the exception of apparatus for lighting and lamps (see Article 20, § 2, 1°, c), of the aforementioned Royal Decree No. 1).

The reverse charge applies to the supply with placement of a charging station, or the supply and placement of a charging point when the charging infrastructure in question is part of the electrical installation of a building, as referred to in § 2, 1°, c), of Article 20, of the aforementioned Royal Decree No. 1 and provided that the other conditions are also met.

If one contract is concluded for the delivery with installation of the charging station (main object), maintenance and other ancillary services (e.g. access to digital platform), the reverse charge applies to the whole, provided that each invoice refers to the contract in question with the delivery and installation of the charging station as its main object.

Example 1: a contract is entered into with a supplier of charging stations under which, in addition to the delivery and installation of the charging station, for a period of 24 months the supplier will also be responsible for maintenance and where an application is provided with which the use of the charging station can be monitored. Every month the user will receive an invoice for these services. It is assumed that the reverse charge applies to the whole, provided that each monthly invoice refers to the contract in question. If the supply and installation of the charging station qualifies for the reduced VAT rate, under these circumstances it also applies to the maintenance and monitoring of that charging station.

Example 2: a contract is concluded for the monitoring of the charging station with a taxable person who is not responsible for the installation and maintenance of the charging station. The reverse charge mechanism does not apply in this case. The taxpayer must charge for his services at a VAT rate of 21%.

Finally, it should be noted that if a foreign taxpayer is called upon for the supply and installation of a charging station, the reverse charge mechanism is always applicable if the customer is a taxpayer established in Belgium and obliged to submit a periodic VAT return as referred to in Article 53, § 1, first paragraph, 2°, of the VAT Code or is a non-resident taxpayer who has had a liable representative recognized in Belgium in accordance with Article 55, § 1, or § 2, of the VAT Code (Article 51, § 2, 5°, of the VAT Code).

2.4. Right to deduction

2.4.1. Charging station installed at a company

A charging station installed at an enterprise is considered as belonging to the electrical installation of the enterprise. The right to deduction should be determined in accordance with Articles 45, § 1 and 45, § 1quinquies, of the VAT Code.

If this installation is used exclusively for carrying out taxable transactions as part of the economic activity that confers the right to deduction, the VAT on the installation costs will be fully deductible. This will be the case if the charging station is only used by the directors, managers and employees of the taxable company with full right of deduction, if customers or suppliers of this taxable company can use the charging station (for payment or not) in the context of their visit to the taxable company or if third parties can use the charging station for payment.

In the case of mixed use, the deduction will be limited.

Even if a charging station is rented by the company and placed on the company's site (and the fee only covers the cost of the charging station and not the electricity supplied), the charging station is considered to be part of the company's electrical installation. The VAT levied on the rental of the charging station is deductible in accordance with the normal rules (application article 45, § 1, of the VAT Code).

By analogy with the administrative position regarding the VAT deduction of parking costs, as communicated in the decision VAT no. E.T.108.474 dated 09.12.2004 the proportion of professional use of the cars to be charged should not be taken into account in these cases. The deduction limitation of article 45, § 2 of the VAT Code is not applicable.

2.4.2. Charging station installed at the employee's premises

It also happens that the employer supplies and installs a charging station at an employee's home (the employee's own home or rented accommodation). In this case, the charging station is obviously not part of the company's electrical installation. There is only a deduction to the extent that the charging station is used professionally.

A distinction should be made between the situation where the charging station is made available to the employee free of charge, or the situation where the employee has to pay a fee to the employer. It should be noted that the term "for no consideration" refers not only to the situation where the charging station is made available to an employee in exchange for a reduction in his net salary, but also to the situation where an employee can opt for a charging station at his home under a cafeteria plan with a points system, but thereby forego other benefits that he could enjoy under the cafeteria plan.

A provision of the charging station by a Belgian taxpayer in exchange for a reduction in the gross salary of a Belgian employee is, for reasons of administrative simplification, considered to be a provision free of charge.

In the situation where the charging station is made available to the employee free of charge, the deduction in accordance with Articles 45 § 1 and 45 § 1quinquies of the VAT Code must be limited to the amount of the professional use of the car. The professional use of the charging station is determined in the same way as the professional use of the electric vehicle made available to the employee. The methods for determining the occupational use of a vehicle made available to an employee are described in the Circular AAFisc. no. 36/2015 (no. E.T.119.650) dated 23.11.2015.

The deduction limitation of article 45, § 2, of the VAT Code, does not apply to the purchase or rental of a charging station.

It should also be noted that if the charging station leaves the company premises for no consideration (for example, if the charging station remains in the home when the employee moves), the VAT implications must be taken into account. A distinction needs to be made between charging stations that are considered movable (e.g., the charging stations on the wall of the home) and charging stations that are considered immovable (e.g., the charging stations anchored in the ground).

For the charging stations that are considered movable, the taxpayer, insofar as he has enjoyed a full or partial right to deduct the VAT levied on the acquisition of the charging station, must make a withdrawal within the meaning of Article 12, § 1, 1°, of the VAT Code. If the charging station was subject to a deduction limitation upon acquisition, Article 10, § 1, first paragraph, 3°, of the Royal Decree no. 3on the right to deduction still allows, in this case, an additional deduction in the form of a revision equal to the amount of VAT originally subject to the deduction limitation, amounting to one-fifth, for the year in which the supply or withdrawal takes place and for the years of the revision period still to run.

In cases where the charging station is considered immovable by nature, a revision in the sense of Article 10, § 1, first paragraph, 1°, of Royal Decree No. 3, aforementioned, should only be made.

Taking into account that it is not always clear to an employer to what extent a charging station installed at an employee's premises qualifies as movable or immovable, the administration will not criticize if the employer only proceeds to a review in the sense of Article 10, § 1, first paragraph, 1°, of Royal Decree No. 3, as envisaged for charging stations that are immovable by nature.

In the situation where the employee has to pay a fee to the employer for obtaining a charging station at his home (for consideration), the deduction restrictions of Articles 45 § 1 and 45 § 1quinquies of the Code do not apply if the provision of the property is made at a fee equal to its normal value (in accordance with article 32, of the VAT Code). This applies both to the situation where the employee rents the charging station from the employer, without a transfer of ownership, and to the situation where the employee becomes the owner of the charging station for a fee. If the employee rents the charging station, the determination of the normal value of the rental will have to take into account the professional use of the charging station, which is determined in the same way as the professional use of the electric vehicle made available to the employee. Reference is made to Administrative Circular AAFisc. No. 36/2015 (No. E.T.119.650) dated 23.11.2015 for further clarification on the calculation of the normal value in the case of the provision for consideration of mixed-use business assets.

Also in this situation, the deduction limitation of article 45, §2 of the VAT Code, does not apply to the purchase or rental of a charging station.

For the sake of completeness, we mention that the in the situation where the provision of the charging station to the employee qualifies as an installment plan, in which the right of ownership on the part of the employee is normally acquired upon payment of the last due date, is equated for VAT purposes with the situation where the employee becomes the immediate owner of the charging station.

The taxable event occurs when the charging station is made available to the employee (see also parliamentary question no. 1027 of Mr. de Clippele of 20.04.1994).

3. Charging of electric vehicles via a charging station

3.1. Nature of the act

In accordance with Article 9, first paragraph, 1°, of the VAT Code, electricity is considered a physical good. Charging the battery of an electric vehicle is done via a charging station. This operation qualifies as a supply of a good. In certain situations, the charging of the electric vehicle is accompanied by a number of additional services. The supply of electricity for consumption by an electric vehicle is treated as a "fuel cost" for the purposes of VAT.

(Semi-)public charging stations.

In such cases, a consumer usually enters into a contract with an issuer of a charging subscription, charging pass or app: the e-mobility service provider (also referred to as 'eMP' or 'eMSP'). The eMP arranges for consumers to access a (semi-)public charging station via charging cards or mobile apps. The eMP also ensures that a consumer can reserve a charging station, provides information to the consumer about the charging station, provides a telephone help desk, etc.

The eMP bills the consumer for these services, including electricity charging.

To provide the services, the eMP enters into agreements with various charging station operators, the charge point operators ("CPO"). Although the CPO is not necessarily the owner of these charging stations, it is responsible in its own name for the operational management of these charging stations.

The CPO provides the eMP with information about the charging stations (including charging station availability, location, type of charging station, available parking, etc.), it ensures access to the charging stations, provides on-site technical support if necessary, and arranges for the electric charging of the vehicles.

The CPO bills the eMP for all these charging services, including electric charging.

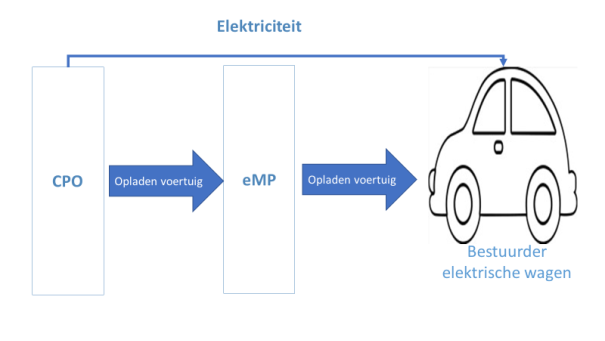

The diagram below shows how vehicle charging takes place:

Within the bosom of the VAT Committee, the question was raised as to how the CPO's services with respect to the eMP qualify for VAT purposes. The VAT Committee unanimously decided that the charging of the battery should be considered the main element of the performance, since the sole purpose of the additional charging services is to facilitate the access of electric cars to the charging station for the purpose of charging the battery of the electric car. Therefore, for VAT purposes, these charging services are considered ancillary to the supply of the electricity as a result of which the entire supply should be considered a supply of a good (guideline taken following the 113th VAT Committee of 03.06.2019 - document A - taxud.c.1(2019)6589787 - 972).

Similarly, the performance of the eMP vis-à-vis the consumer in its entirety should also be considered a supply of electricity, with the associated charging services considered incidental.

In accordance with Article14bis(b) of the VAT Code, the supply of electricity by the eMP to the consumer takes place where the consumer has the effective use and consumption of the electricity. Consequently, in the eMP-consumer relationship, Belgian VAT is always due when charging an electric vehicle via charging stations located in Belgium. If the charging station is located outside Belgium, no Belgian VAT is due on this service.

Example: a Dutch motorist purchases electricity via a public charging station in Antwerp. Belgian VAT is always due on the purchase of the electricity, even if the motorist is a taxable person.

It should be noted that, should the eMP be a taxpayer not established in Belgium, account must be taken of Article 51, § 2, 5°, of the VAT Code, which stipulates that the reverse charge always applies if the customer is a taxpayer established in Belgium and obliged to submit a periodic VAT return referred to in Article 53, § 1, first paragraph, 2°, of the Code or is a non-resident taxpayer who has had a liable representative recognized in Belgium in accordance with Article 55, § 1, or § 2, of the VAT Code.

Example: a Belgian taxpayer, who files periodic VAT returns, enters into an agreement with an eMP established in France, allowing its employees to use public charging stations throughout the European Union. These supplies that took place in Belgium in accordance with Article 14bis(b) of the VAT Code (i.e., the charging operations that took place on Belgian territory) are invoiced without VAT to the Belgian taxpayer. In accordance with Article 51, § 2, 5° of the VAT Code, the Belgian taxpayer is obliged to pay the VAT due by shifting it to his periodic VAT declaration.

In the relationship CPO - eMP, the provisions of article 14bis, a) of the VAT Code must be taken into account and the supply is deemed to take place where the seat of the economic activity of the eMP, or its permanent establishment, is located. Indeed, the eMP qualifies as a taxpayer whose main activity in the field of electricity consists in reselling those goods and whose own consumption of those goods is negligible.

VAT on these purchases is payable by the acquirer, the eMP, in accordance with Article 51, § 2, 6°, of the VAT Code, if the CPO is not established in the same Member State as that acquirer. This means that where an eMP established in Belgium enters into an agreement with a CPO not established in Belgium for the charging of electric vehicles (this may be the case where the CPO's charging stations are located in another Member State), the place of supply of this electricity is Belgium and the eMP will be liable to pay the VAT through its periodic VAT return. Conversely, a CPO established in Belgium will not have to charge VAT for the supply of electricity when the eMP is not established in Belgium.

Example: a Belgian supermarket puts its charging stations at the disposal of a foreign eMP and is thereby remunerated per kwh purchased. No Belgian VAT should be charged since the place of supply is deemed to be where the foreign eMP is established (application of article 14bis, a), of the VAT Code). If the supermarket would deliver the electricity directly to its customers (without the intervention of an eMP), the supermarket would take the place of the eMP with respect to the place of supply and the supply would take place in Belgium in application of article 14bis, b) of the VAT Code.

3.1.2. Charging stations made available to employees

The employer provides an electric vehicle to the employee and may also provide a charging station at the employee's premises (if the employee does not already have his own charging station). The employee can charge his electric car at home. The employee has an agreement with his electricity supplier and receives periodic bills regarding consumption (advances and balance). The employer reimburses the employee for the portion of the paid electricity used for the electric company car.

In this context, the employer normally enters into an agreement with an e-mobility service provider (also called "eMP" or "eMSP"). This service provider assists employers by taking care of reading the meters, making payments to employees in the name and on behalf of the employer and reclaiming the respective amounts from the employer. The eMP performs a service of reading the meters and preparing the documents.

No margin is usually taken on the recharge of the electricity cost. Fees are often determined on a flat-rate basis (e.g., based on the on-board tables of the energy regulator).

3.1.2.1. VAT implications under the eMP.

The administration found that there are several solutions offered by eMPs to reimburse the employee for charging electricity through a charging station at the employee's home.

Option 1: Electricity is reimbursed by the employer directly to the employee.

Under this scenario, the role of the eMP is limited to reading meters, processing and transmitting the data of electricity purchases to the employer. The eMP does not intervene in the reimbursement of electricity charging to the employee.

Consequently, the eMP provides a service referred to in Article 18, § 1, of the VAT Code. In accordance with Article 21, § 2 of the VAT Code, this service is taxable in Belgium when the recipient of the service is a taxpayer established in Belgium or a permanent establishment of a foreign taxpayer established in Belgium. This service is subject to the VAT rate of 21%.

Possibility 2: The employer calls on the eMP to reimburse the employee for electricity. Here, the eMP acts in the name and on behalf of the employer.

Under this scenario, the role of the eMP is not only limited to reading meters, processing and forwarding the data of the electricity purchase to the employer, but the reimbursement for charging the electricity to the employee also goes through the eMP. It is contractually provided that the employer still purchases electricity directly from the employee and the intervention of the eMP is limited to financial settlement in the name and on behalf of the employer.

Article 28, 5°, of the VAT Code provides that the sums advanced by the service provider for expenses incurred by him in the name and on behalf of his co-contractor shall not form part of the taxable amount, if it is shown separately on the invoice. An appropriate entry should be made on the invoice (for example, "advance payment within the meaning of Article 28, 5°, of the VAT Code"). It may also be opted by the eMP not to mention the amount of the advance on the invoice issued for its services, but to work with a separate payment document that is not included in the VAT accounts.

The VAT qualification of the eMP's services is the same as in option 1. The intervention in the financial settlement of the electricity purchase is considered ancillary to the general service performance of the eMP.

Option 3: The employer calls upon the eMP to reimburse the employee for the electricity. Here, the eMP acts in its own name and on its own behalf. Under this scenario, the eMP actively participates in the commodity chain.

Contractually, the employee sells the electricity to the eMP, who then resells this electricity to the employer.

Under these circumstances, the supply made by the eMP to the employer is regarded in its entirety as the supply of electricity. Consequently, the VAT implications are the same as mentioned under 3.1.1.

3.1.2.2. VAT consequences on the part of the employee

In the event that an employee receives an amount for the electricity charged through the charging station, there is a supply for consideration of a good.

However, if the employee concerned has no other activity for which he is a VAT taxpayer and the vehicles charged via the charging station, other than the employee's own vehicles, belong to or are leased by the employer of the person concerned (or another member of his family), the administration assumes that, with respect to his supplies of electricity, in view of their small size, that employee is not engaged in an economic activity within the meaning of Article 4 of the VAT Code and therefore does not have the status of a VAT taxpayer. Consequently, said supplies of electric power are not subject to VAT.

If the employee in question does carry out another activity for which he is liable to pay VAT and the vehicles charged via the charging station, other than the employee's own vehicles, belong to or are leased by the person's employer (or another member of his family), the administration will also assume that such supplies of electricity are not part of his normal economic activity. Indeed, in this case, the income received by the employee from the employer is not the result of active management of the charging station by the employee and therefore falls outside the scope of VAT. The employee is also deemed to be acting as a non-taxable person under these circumstances.

Should the charging station be made available to the general public by the employee, the factual circumstances will have to be taken into account from which it will have to be shown to what extent there is still a minor economic activity that does not result in acquiring the status of VAT taxable person.

3.1.2.3. VAT implications on the part of the employer

There are no direct VAT obligations on the part of the employer.

However, it should be noted that, on the fees for the supplies of electricity paid by employers to the employees, using options 1 or 2 mentioned under 3.1.2.1., no VAT can be deducted, as no VAT is due on these supplies. Moreover, allowing a right of deduction of VAT levied on the fuel allowance paid to the employee would be incompatible with the VAT Directive (judgment of the Court of Justice of the European Union of 10 March 2005, C-33/03, Commission v. United Kingdom).

3.2. Tariff

As regards the supply of electricity, the standard VAT rate of 21% applies.

3.3. Right of deduction

The administration assumes that the provision of electricity via car charging stations by a taxpayer is considered a supply of goods within the meaning of Articles 9 and 10 of the VAT Code.

The electricity purchased via the charging stations by a taxable company is subject to the deduction limitation of article 45, § 1 of the VAT Code, (professional use) whereby the application of the deduction limitation contained in article 45, § 2 of the VAT Code should not be overlooked.

If electricity consumption can be measured separately for each vehicle, the right to deduction can be determined according to the same deductibility regime as for the vehicle. The simplification measure included under point 3.3.2.2. of Circular AAFisc No. 36/2015 (No. E.T.119.650) dated 23.11.2015 may be applied here.

On the other hand, if the charging of electricity via the charging station cannot be measured separately from other electricity consumption, the deduction percentage should be determined under the supervision of the administration.

The above applies to the purchase of electricity via public charging stations, as well as to charging stations located on the company's site.

Finally, it is noted that when recourse is made to an eMP that has not itself intervened in the supply of electricity (see, inter alia, options 1 and 2 under 3.1.2.1. above), the VAT on the actions of the eMP are considered general expenses, subject to the deduction limitation of Article 45, § 1 of the VAT Code, but not to the deduction limitation of Article 45, § 2 of the VAT Code. This also applies to the purchase of devices whose sole purpose is to monitor electricity purchases from employees' homes.

Internal ref: 137.848